43 zero coupon bonds tax

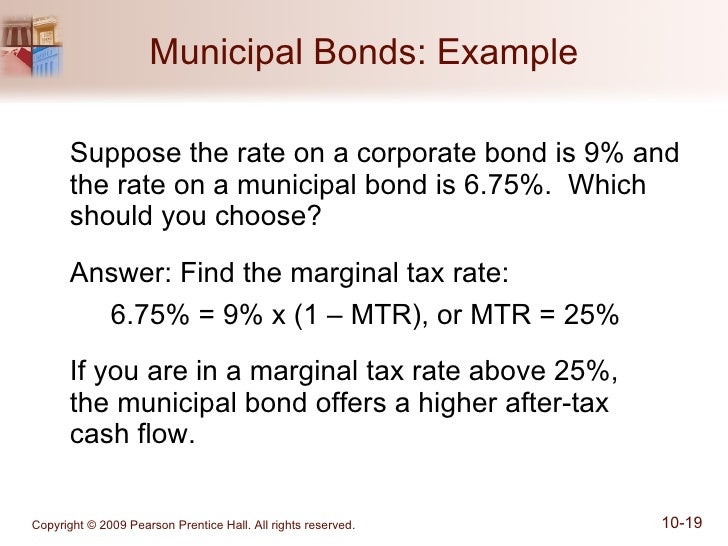

Do you pay taxes on zero coupon bonds? - Quora When zero coupon bonds first came out, you only paid tax when you sell them or at the end of their terms when you cash them in. This was one of the attractive aspects of zero coupon bonds for some people. For example, suppose you were currently aged 58 and earning enough money to be in a fairly high tax bracket. What is the tax implication on zero coupon bonds? Updated. Any long term capital gain on sale of zero coupon bonds shall be charged to tax at minimum of the following: 20% of LTCG After indexation of cost of such bonds or 10% of LTCG before indexation of cost of such bonds. Zero coupon bonds, Investing in Zero Coupon Bonds, Tax Considerations for Zero Coupon Bonds Explained the tax implication ...

Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 - TaxWink Proviso to Section 112(1) prescribes the manner of calculating tax on long term capital gain on zero coupon bonds. According to this proviso, tax on long term capital gain on zero coupon bonds shall be lower of the following: - (a) Tax on capital gains computed normally @ 20% on difference of maturity price and purchase price (indexed) or

Zero coupon bonds tax

Taxation of Zero coupon bonds | P2P Independent Forum Feb 23, 2017 at 3:19am nick said: Zero coupon bonds or any debt issued at a deep discount (those issued at 0.5%pa+ discount to maturity value) are generally taxed as income at maturity. There are a few exceptions to this treatment eg for life insurance policies, but none would seem to apply in this case. › investors › insightsThe One-Minute Guide to Zero Coupon Bonds | FINRA.org After 20 years, the issuer of the bond pays you $10,000. For this reason, zero-coupon bonds are often purchased to meet a future expense such as college costs or an anticipated expenditure in retirement. Federal agencies, municipalities, financial institutions and corporations issue zero-coupon bonds. › articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon U.S. Treasury bonds have a poor risk-return profile when held alone. Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run ...

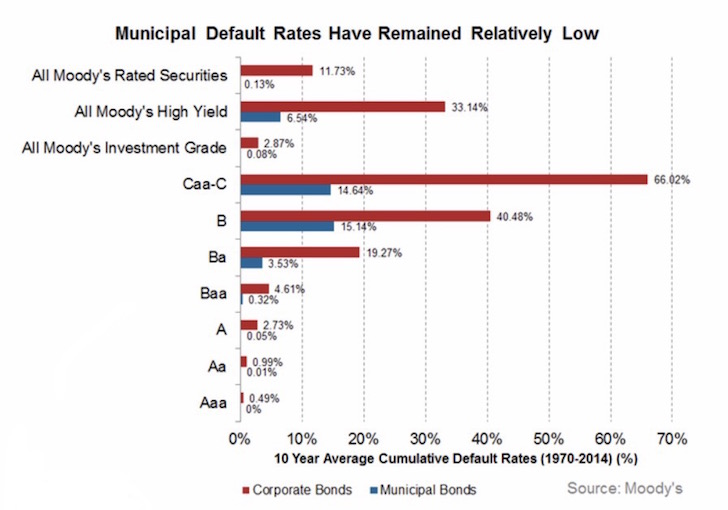

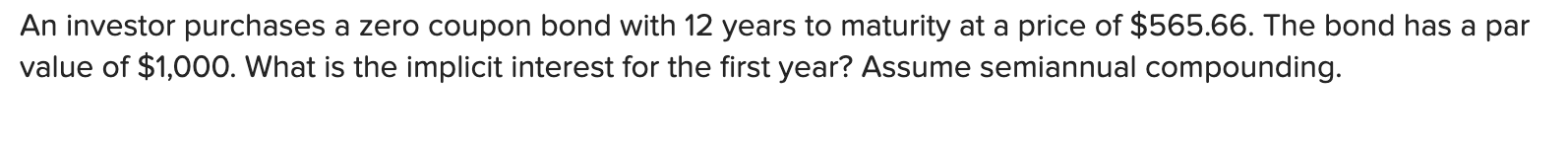

Zero coupon bonds tax. Zero-Coupon Bonds: Definition, Formula, Example ... - CFAJournal With zero-coupon bonds, the bondholders need to pay taxes associated with interest income, regardless of the fact that the particular gain has been realized or not. For example, with a bond that is maturing in 5 years, the lump sum return is going to be generated at the end of the period only. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: You must pay tax on interest annually even though you don't receive it until ... Impact of Taxation on Zero-Coupon Muni Returns - MunicipalBonds.com Taxation on zero-coupon munis is only realized upon their sale or maturity. If the bond is sold before its maturity, it is either sold at a discount or a premium in the secondary market. Any price paid above the adjusted issue price (discussed below) will be premium and any price below the adjusted issue price will be discount.

Zero Coupon Bonds (ZCB) & its taxation in the hands of investor S.36 (iiia) of Income Tax provides that the fund or company which issues the zero coupon bonds shall be entitled to claim deduction on pro-rata basis for the amount of discount on the zero coupon bonds considering the tenure of such bond, in the manner as may be prescribed. For the purposes of allowing pro-rata deduction to the issuer company: Zero-Coupon Bond: Formula and Calculator [Excel Template] If we input the provided figures into the present value (PV) formula, we get the following: Present Value (PV) = $1,000 / (1 + 3.0% / 2) ^ (10 * 2) PV = $742.47. The price of this zero-coupon is $742.47, which is the estimated maximum amount that you can pay for the bond and still meet your required rate of return. calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with dividends reinvested by 500% over the subsequent 30-years as interest rates fell from around 14.6% to around 3%. I started investing in 30 Year zero coupon treasuries. Now, zero coupon bonds don't pay any interest ... The ABCs of Zero Coupon Bonds | Tax & Wealth Management, LLP Zero coupon bonds are subject to an unusual taxation in which the receipt of interest is imputed each year, requiring holders to pay income taxes on what is called "phantom income." Target Dates. For individuals, zero coupon bonds may serve several investment purposes.

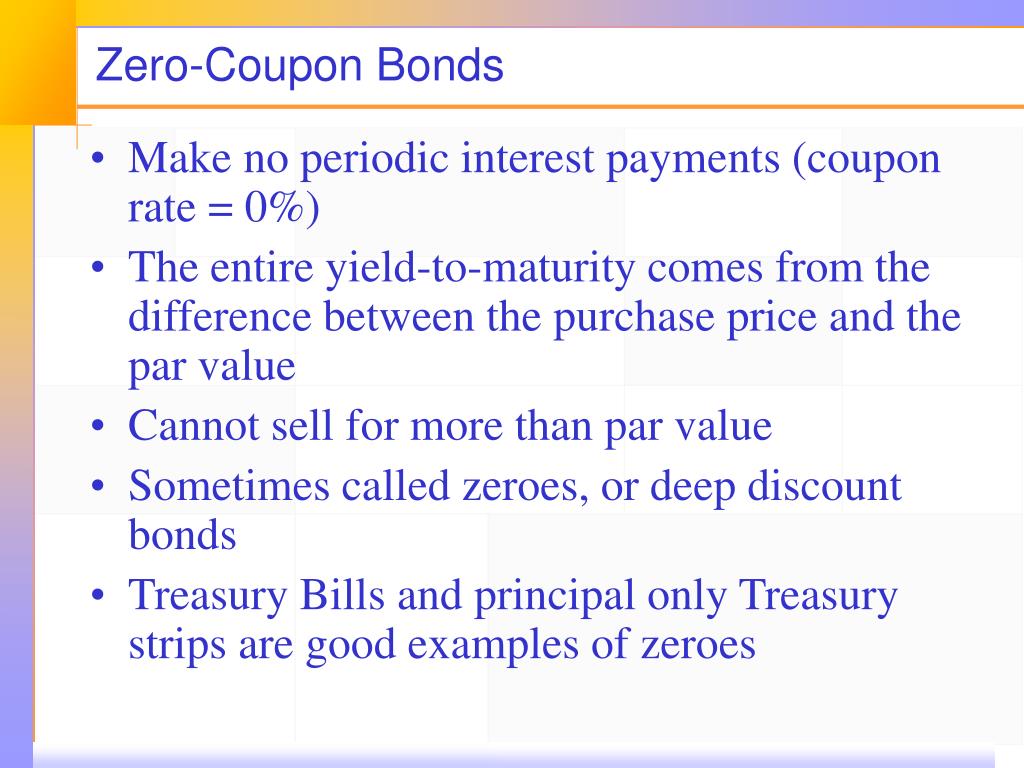

Zero-Coupon Bonds - Tax Professionals Member Article By Carmen Garcia A zero-coupon bond is a type of bond that earns no interest during its lifetime. A zero-coupon bond is issued with a sudden reduction in par value or face value, which is the amount that will be paid for the bond at maturity. An investor receives a one-time interest payment at maturity equal to the difference between the face value and the ... TAXABILITY OF ZERO COUPON BONDS - The Tax Talk Zero coupon bonds are taxable under two heads depending upon how the bond is held. If the bonds are held as capital asset, these are taxable under the head "Income from Capital Gains". These can be short term or long term depending upon the holding period. i.e. 12 months. Long term Capital gains will be taxable at the rate of 10%+ cess. No › gstripsInvest in G-SEC STRIPS India - Bondsindia.com Stripping is the process of separating a standard coupon-bearing bond into its individual coupon and principal components. For example, a 10 year coupon bearing bond can be stripped into 20 coupon and one principal instruments, all of which thenceforth would become zero coupon bonds. How to Buy Zero Coupon Bonds | Finance - Zacks CDs. Zero coupon bonds, also known as zeros, are distinct in that they do not make annual interest payments. The bonds are sold at a deep discount, and the principal plus accrued interest is paid ...

Taxes and zero coupon bonds - FMSbonds.com Tax-exempt interest earned on zero coupon bonds should be reported on your 1040, along with all other tax-exempt interest received. The interest reported is based on the original issue price and yield or, as you stated, "the bond's original accretion.". Your adjusted basis in the bonds at any time after purchase would be your actual ...

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest that will be earned over the 10-year life ...

Tax Considerations for Zero Coupon Bonds - m.finweb.com With a zero coupon bond, you are not paid any interest over the life of the bond. At the end of the bond, you get the face value of the bond. The difference with this type of bond is that you can buy the bond at a serious discount to what its end value is. For example, you may only pay 70 to 80 percent of the value of the bond when you buy it.

Section 2(48) Income Tax: Zero Coupon Bonds - CA Club a) Meaning of 'Zero Coupon Bond': Section 2 (48) Income Tax As per Section 2 (48) of Income Tax Act, 1961, unless the context otherwise requires, the term "zero coupon bond" means a bond- (a) issued by any infrastructure capital company or infrastructure capital fund or public sector company or scheduled bank on or after the 1st day of June, 2005;

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond is a discounted investment that can help you save for a specific future goal. Tara Mastroeni. Updated. Jul 28, 2022, 9:13 AM. Buying zero-coupon bonds can be a good deal for ...

Zero Coupon Municipal Bonds: Tax Treatment - TheStreet , the tax rules for zero-coupon bonds bought as new issues and held to maturity are fairly simple. Whether the bond is taxable or tax exempt, you have to accrue interest on the bond. That means you...

› glossary › zero-coupon-bondZero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years.

› terms › zZero-Coupon Bond Definition - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Zero-coupon bond - Wikipedia Alternatively, when a zero coupon bond issued by a US state or local government entity is purchased, the imputed interest is free of U.S. federal taxes and, in most cases, state and local taxes. Zero coupon bonds were first introduced in the 1960s but did not become popular until the 1980s.

› tcir › tcir_zerocouponGovernment - Continued Treasury Zero Coupon Spot Rates* Aug 14, 2013 · Continued Treasury Zero Coupon Spot Rates* ... IRS Tax Credit Bonds Rates; Treasury's Certified Interest Rates. Federal Credit Similar Maturity Rates.

How is tax calculated on a zero coupon bond? - Quora When zero coupon bonds first came out, you only paid tax when you sell them or at the end of their terms when you cash them in. This was one of the attractive aspects of zero coupon bonds for some people. For example, suppose you were currently aged 58 and earning enough money to be in a fairly high tax bracket.

Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia The municipal zero-coupon bonds can help you save tax on the interest income. Advantages of Zero-Coupon Bonds Meet Long-term Goals Zero-Coupon Bonds don't offer regular interest. Instead, the earned interest is accumulated and paid at the maturity. It thus helps create funds that can help meet your long-term goals. Fixed Returns

Tax Considerations for Zero Coupon Bonds - Financial Web Tax Considerations Zero coupon bonds have unique tax implications. Technically, you are earning interest every year, even though you do not see it until the end of the bond term. Therefore, you have to pay the taxes on the interest every single year even though you do not get the interest until the end of the arrangement.

› articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon U.S. Treasury bonds have a poor risk-return profile when held alone. Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run ...

› investors › insightsThe One-Minute Guide to Zero Coupon Bonds | FINRA.org After 20 years, the issuer of the bond pays you $10,000. For this reason, zero-coupon bonds are often purchased to meet a future expense such as college costs or an anticipated expenditure in retirement. Federal agencies, municipalities, financial institutions and corporations issue zero-coupon bonds.

:max_bytes(150000):strip_icc()/the-difference-between-stocks-and-bonds-417069-final-5bbd17bd46e0fb00268fdc8c.png)

Post a Comment for "43 zero coupon bonds tax"